When is tax time? Here’s what you need to know before filing your 2023-24 tax return

Athena’s company pays her $78,000 in employee salary and bonuses, and a $42,000 shareholder distribution, saving her about $5,000 in payroll taxes compared to operating and being taxed as a sole proprietorship. Once you’ve officially become an S corporation, you’ll first need to decide upon a reasonable salary to pay yourself. Some of these factors include your qualifications, the size and complexity of your https://www.bookstime.com/ business, and the average rates of compensation others earn in similar positions with similar companies. I recommend completing the S-Corporation Reasonable Compensation Report to find the best salary for you. Start by forming an LLC for your business, then file Form 2553 with the IRS for S Corp tax status. If you find the process time-consuming or confusing, there’s help for business owners like you.

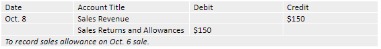

Filing Requirements: IRS Form 1120S Return for an S Corporation

As a pass-through entity, one of the biggest tax advantages of the S corp business structure is that it avoids double-taxation, which means S corps don’t have to pay taxes at the federal level the way C corps do. Instead, S corp profits are only taxed once, on the personal tax returns of individual shareholders. However, shareholders who incur out-of-pocket expenses related to the business cannot be deduct them on their tax return. Instead, an expense claim form must be submitted to the S corp, which pays the shareholder back. C corps pay corporate taxes on their earnings, the way individuals pay income taxes. (In the U.S., corporations are currently taxed at a flat rate of 21%.) Any dividends or other profits are then distributed to shareholders with after-tax funds.

S Corp payroll services

- Deciding between an S Corp and an LLC is a critical decision for business owners.

- Trump announced his tax-free-tips plan at a June 9 rally in Nevada, a key battleground state with six electoral votes in the race for the White House.

- But you should notice the changes in your pack packet from July 1 because slightly less tax will be deducted from your take-home pay.

- TurboTax Live Assisted Business is perfect for partnerships, S-corps, and multi-member LLCs.

- Then you’ll file Form 2553 with the IRS to request the S Corp tax designation.

- Just like any other employee would, you have to report your salary on your taxes.

Check with your state department of revenue for more information on sales and excise taxes. If any of the owners also are employees, they receive a salary, from which FICA taxes (Social Security and s corp payroll Medicare tax) are withheld. To the untrained ear, employee classification might seem insignificant. The frequency of S Corp payroll can be more flexible, especially when you’re the only owner.

- Taxpayers making estimated tax payments should consider this deadline to avoid falling behind on their taxes and facing possible underpayment penalties.

- Click here to read our full review for free and apply in just 2 minutes.

- All other income is paid to shareholders in the form of “distributions” that are not subject to self-employment tax, which makes S corporation status very attractive to many small businesses.

- One of the hallmarks of S corporations is taxation only at the shareholder level.

- I recommend completing the S-Corporation Reasonable Compensation Report to find the best salary for you.

S corp status can save some serious silver

Payroll taxes include the employment taxes you and your employees pay for federal and state programs, including Social Security, Medicare, unemployment insurance and disability benefits. They also include income tax deducted from your employees’ pay and other payroll tax deductions, such as those for health care benefits and paid leave. If you’re not active in your company’s operations and don’t provide services to the S-corp, you can receive compensation as distributions rather than a salary. The primary difference between a salary and distributions is that distributions are not subject to employment taxes. However, they are considered part of a shareholder’s personal income for tax purposes.

7 assistance at IRS.gov

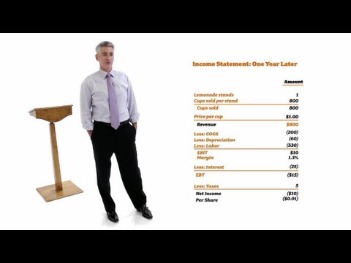

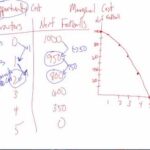

Some taxpayers fail to include this in their calculations, and it’s a big number to pay attention to. The owners of the S corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual Form 1040. For example, if the profits of the S corp are $100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on $25,000 in profits. Similar to other business with employees, S corporations run payroll by calculating income tax, FICA taxes and unemployment taxes based on the wages earned during a given pay period. Yet, they are unlike some larger organizations because they tend to have more flexibility with payroll, especially if there’s only one employee/shareholder. In these cases, individuals may pay themselves in varying frequencies or even divide their income into a few small payments and a large year-end bonus.

Other Payroll Costs and Deductions

The wage base subject to federal and state unemployment tax also changes annually. The amount of wages subject to FUTA and SUTA taxes is capped based on the wage base for each. You might make state unemployment tax payments along with payroll or as a separate payment each month or quarter, depending on the processes available in your state.

- Both S corps and LLCs are known as pass-through entities because they pay no corporate taxes.

- To get S corporation tax treatment, register your business as a C corporation or limited liability company (LLC).

- Set your business up for success with our free small business tax calculator.

- The landscape of S Corp taxation continually evolves due to legislative changes and economic shifts.

- This justifiable salary considers various factors, including industry norms, the duties you perform, your level of training, and the time you dedicate to your business.

- You still have to pay income taxes on the salary and profit that you earn.